Opportunity for Electric Two-wheeler (e-2W) in Hyperlocal Economy of India

by , e -

With the pandemic a state of all pervasive geographical immobility has prevailed for a while now. There has also been an increased dependence on delivery of essentials goods. The pandemic has adversely impacted the workforce, testing capacities of the existing systems. During this ongoing crisis, home delivery options have become the “new normal” in domains like healthcare, food, grocery, and logistics services delivery, and are expected to grow further in 2021. As per reports, online food and grocery retail is predicted to grow from 0.3% (14,100 crore INR) in 2019 to 2.3% (135,000 crore INR) by 2024, with a Compound Annual Growth Rate (CAGR) of 57%. In 2018, the hyperlocal segment, where two-wheelers (2W) are the preferred mode of delivery, raised investments of about INR 612 crore.

This growth will also lead to massive job creation in this space. According to a report, in 2019-20, out of 21 lakh jobs in Indian metro cities, 14 lakh were in the space of gig economy, of which 8.02 lakh positions were in the food and e-commerce delivery space. With the emergence of gig economy, the usage of 2W has risen in the commercial application. This highlights the changing dynamics of private vehicle use for commercial gain, which does not necessarily mean more vehicle on roads but an increase in passenger kilometer, i.e., transport of one passenger over one kilometer or vehicle running time on roads.

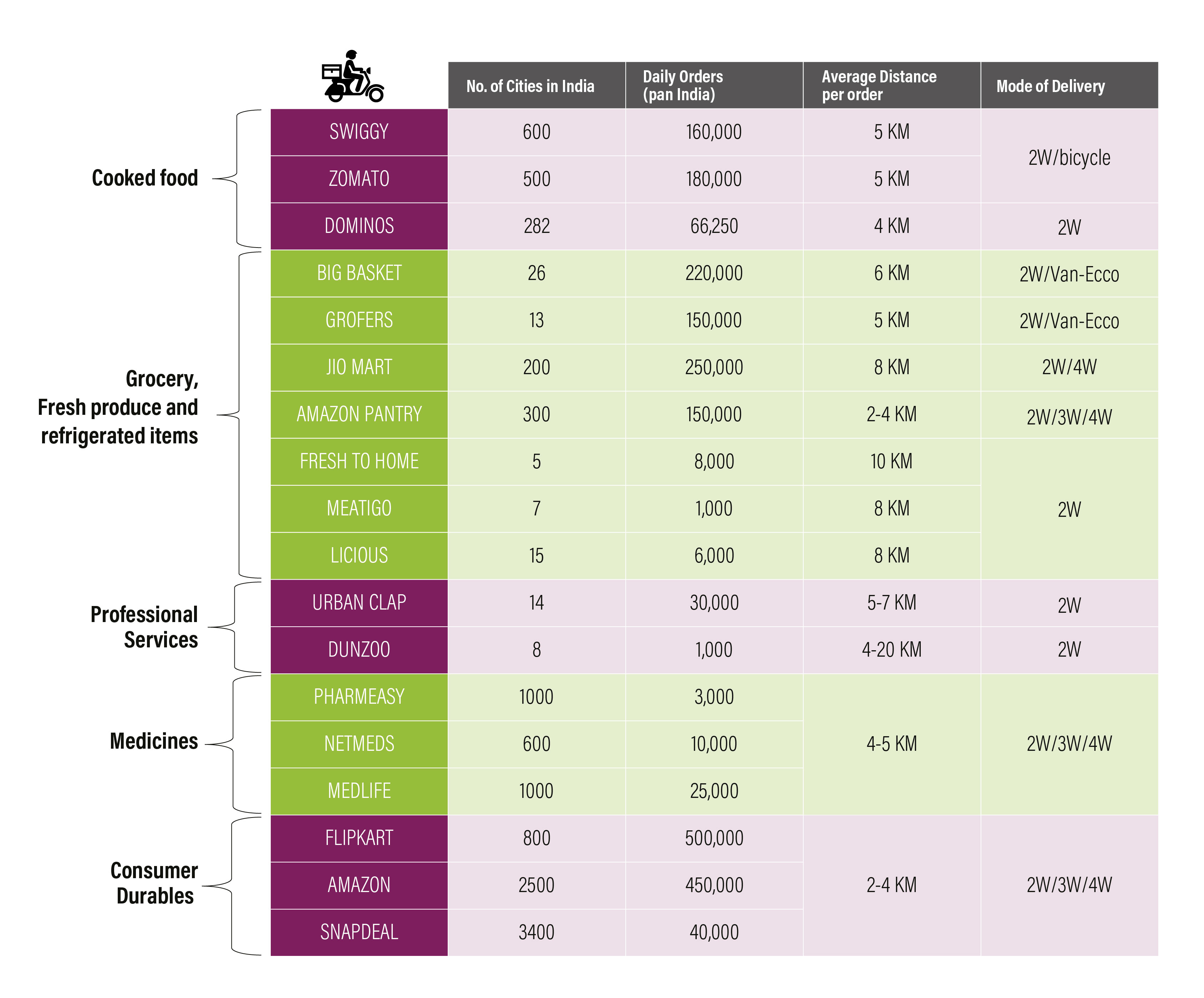

2W in Hyper-Local Delivery

In last-mile delivery, the agents of courier companies deliver packages from the central hub to the customer’s doorstep in areas up to 30 kilometer using bikes, vans, or other transport modes. This takes time up to 12-16 hours. In hyperlocal delivery, the courier agent mainly delivers the product from the seller to the customer within an area of 5-15 kilometres using mainly 2Ws in a time range of 2-8 hours. Also, there are no package restrictions in last-mile deliveries whereas hyperlocal deliveries usually cover packages up to 12 kilograms, mostly essentials like groceries, medicines, food items, tiffin boxes, etc., (Figure 1). According to Traxn (2015), there are more than 110 registered companies for on-demand hyperlocal service delivery across various Indian cities; including those in small- and medium-sized towns. While the scale of these companies varies from 100 orders per day to 1,000 , the use of 2Ws remains the constant factor in fulfilling last mile delivery.

Electric two wheelers (e-2Ws) in Hyper-Local Delivery

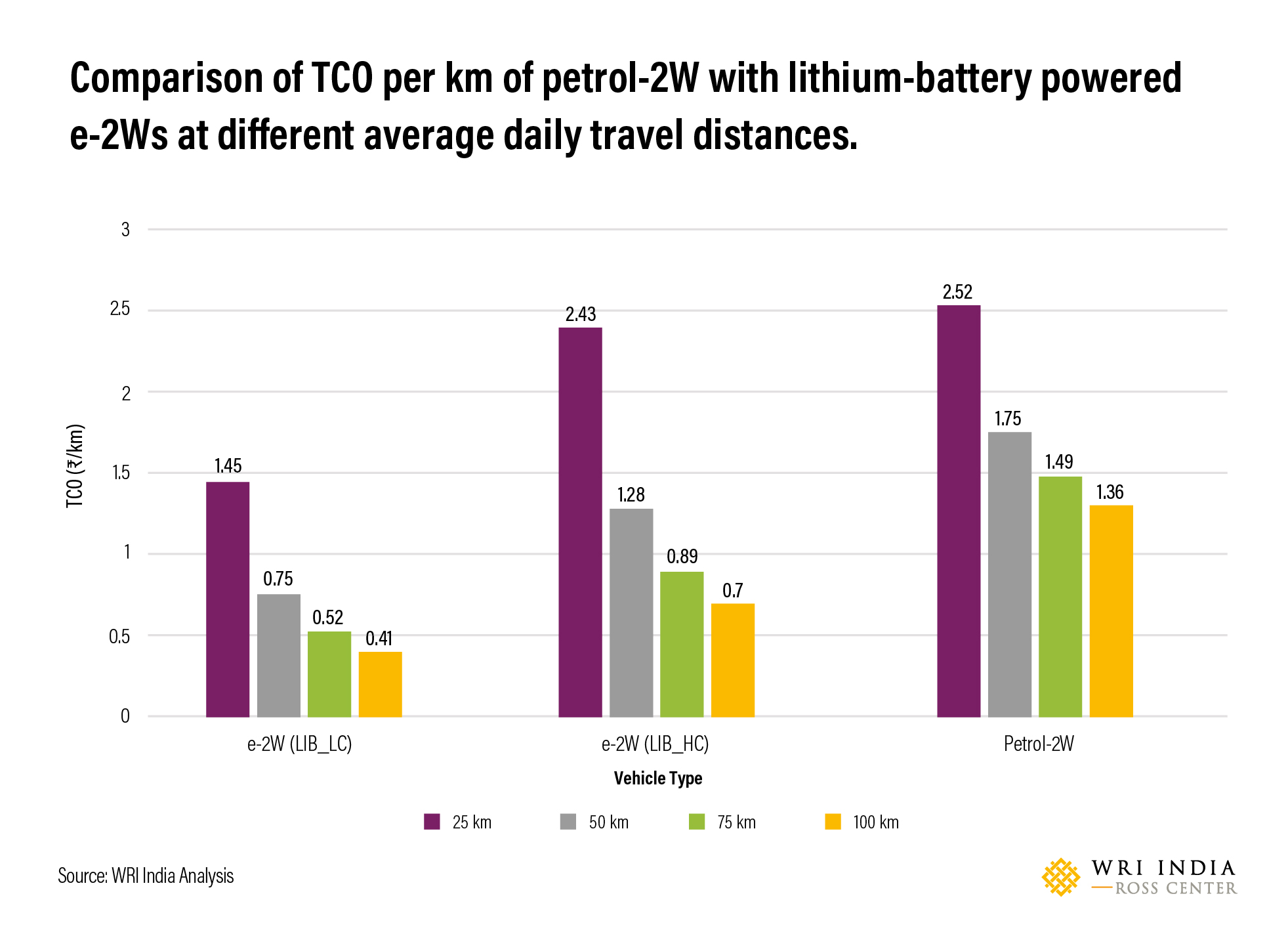

While consolidation of goods is possible in the first and second leg of journey, the last-mile is challenging because of the substantial cost which makes up 40% of the overall supply chain cost. The challenge here is to reduce the last mile cost so as to maximise cost benefits. A well-taken path to reduce cost at the driver’s end is adopting Electric Vehicles (EVs), which results in saving cost of fuel,therefore increasing the net income by 30-40%. WRI India’s Total Cost of Ownership (TCO) analysis suggests that the e-2Ws are more economically viable than their Internal Combustion Engine (ICE) counterpart (Figure 2). At an average daily travel distance of 50 kilometer, the TCO per kilometer of low-cost e-2Ws using Lithium-ion battery (LIB_LC) is ~57 % and high-cost e-2W using Lithium-ion battery (LIB_HC) is ~27% less than petrol-2W. With increasing use of vehicles, the economic viability of e-2Ws further depletes, creating a significant business opportunity for e-2Ws in last-mile and hyperlocal delivery.

As the moment, e-2W manufacturers, operators and aggregators are collaborating with e-commerce, food and groceries giants to increase the penetration of e-2Ws in last-mile and hyperlocal delivery. For example, Zypp, eBikeGo are providing e-2Ws through rental subscription models at fixed per kilometer rate. In 2019, Swiggy, Zomato, Flipkart announced conversion of around 40% of their fleet to bicycles and e-2ws. Recently, Mobility start-up Welectric’s partnered with MoEVing to accelerate adoption of e-2ws in last mile delivery. While the aim is to provide solutions for high upfront costs, such partnerships thrive under enabling conditions through financial incentives, vehicle scrappge policy and sale of e2w without batteries. Moreover, availability of fast and convenient charging solutions near fulfilment centers and other goods suppliers further helps accelerate e-2W adoption.

Accelerating the Adoption of E2W

In the sphere of urban goods delivery, 2Ws are emerging as a preferred option for last-mile and hyper-local delivery. The adoption of e-2Ws helps reduce the operational cost as well as keep emissions in check. Following are recommendations to accelerate the adoption of e-2Ws in the hyperlocal delivery segment:

- Reduction of GST on batteries from 18% to 5% as in the case of EV would open up the possibility of battery leasing and battery swapping.

- Plug-in charging options are time-consuming, and fast plug-in charging affects battery life and performance. Battery swapping can offer a similar re-fuelling experience as a petrol-2Ws, and can also help in reducing the upfront purchase cost of the e-2W by 30-40%. Moreover, battery swapping also ensures better performance, safety, and long life of the battery.

- Innovation in business model, financing, and other enabling environments including easy loan re-payment options will help accelerate the adoption of e-2Ws in the hyperlocal delivery segment.

- Formation of strategic alliances between key stakeholders, which must be based on mutual benefits and risk sharing mechanism, to accelerate transition of petrol-2W to e-2W in hyperlocal delivery sector.

Views expressed are the authors’ own.